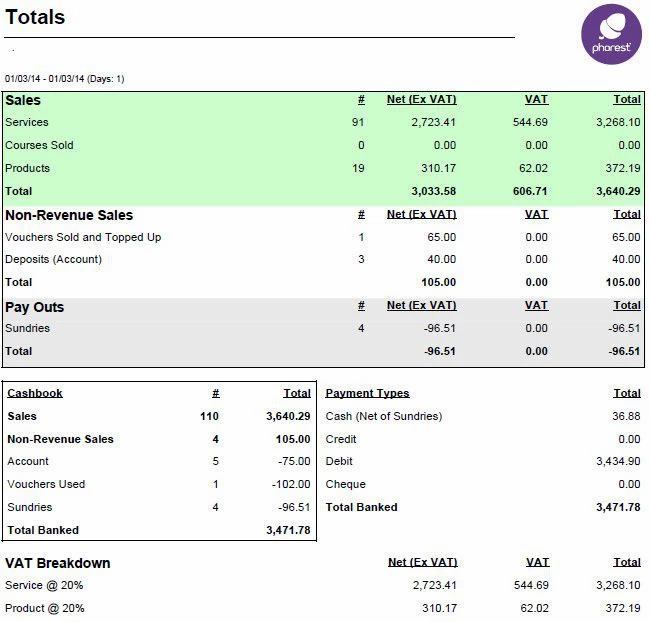

The Financial Totals report gives you a financial breakdown for the selected period of time.

Sales

The sales section lists

- The quantity of services, courses and products sold

- The revenue generated Ex VAT on services, courses, and products.

- The VAT incurred on services courses and products.

- The total for all quantities.

Non-revenue Sales

Non revenue sales apply to vouchers and deposits. With these sales the client is not purchasing a product or service so no VAT can be applied until they spend the voucher or deposit. It shows the number of vouchers sold along with the amount generated on voucher sales

It also shows the amount of revenue generated on deposits

Below both of these sections it shows a total figure for sales and non revenue sales combined

Cashbook

The Cash-book gives an overview of where the money has come in to the business and where any expenditure has gone, for example, money spent like petty cash or clients adding money to a credit account.

Payment type breakdown

This section gives you a breakdown of money taken by different methods during the period of time selected along with a total value banked.

It also displays the value of vouchers redeemed (not sold) along with any other payment methods required.

VAT Breakdown

This section gives you a rundown of the VAT incurred and the % rates applied.