To learn about more areas like this in your Phorest system enrol in our Staff Setup series in Phorest Academy - online, on-demand and on-the-go learning for busy salon professionals.

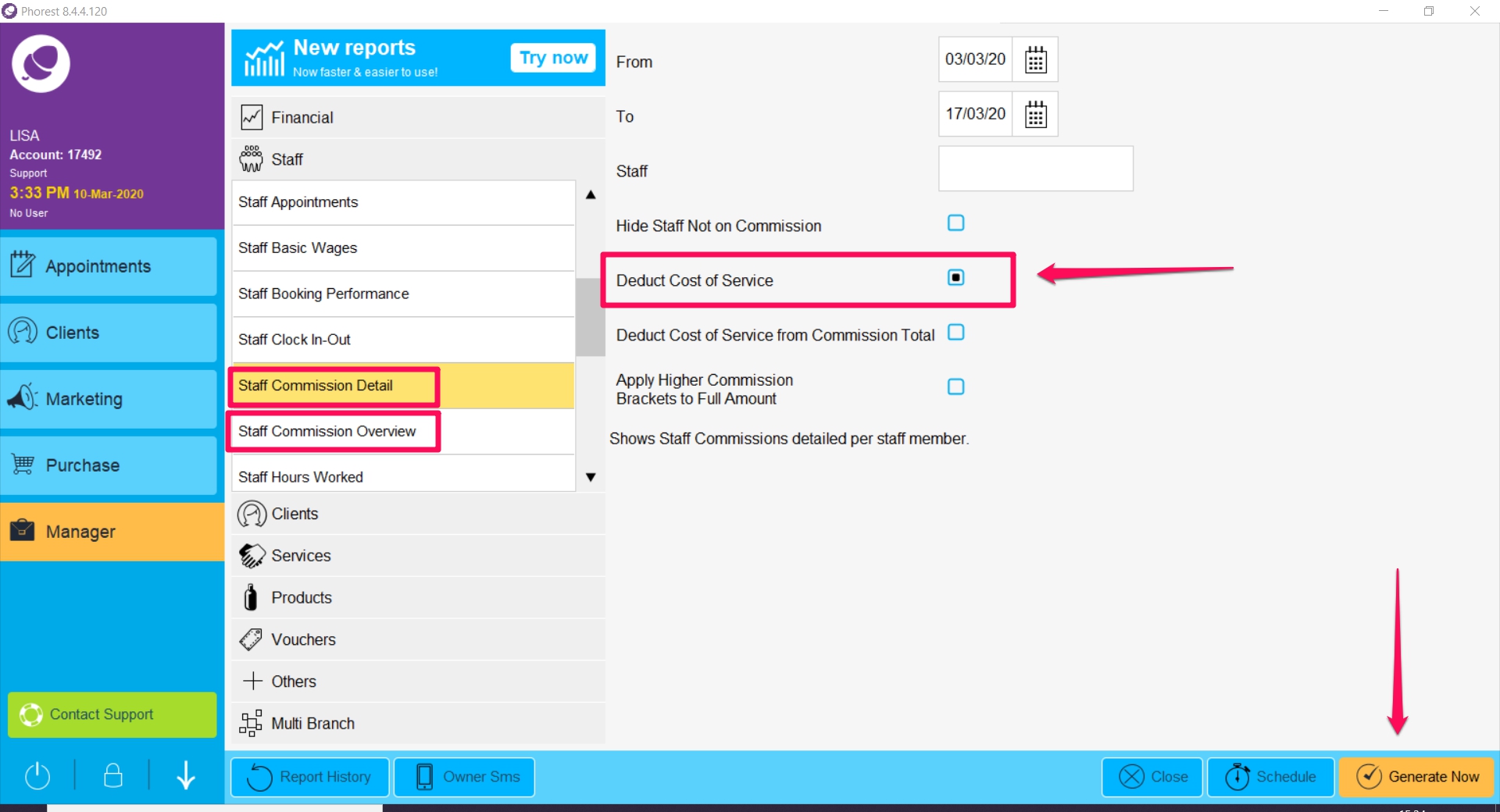

This is very useful if you are splitting revenues with self-employed therapists or stylists. For example, if you have a person with whom you split their revenue 50-50. You may want to deduct the cost of delivering the service (which you are paying for) before applying the 50-50 split.

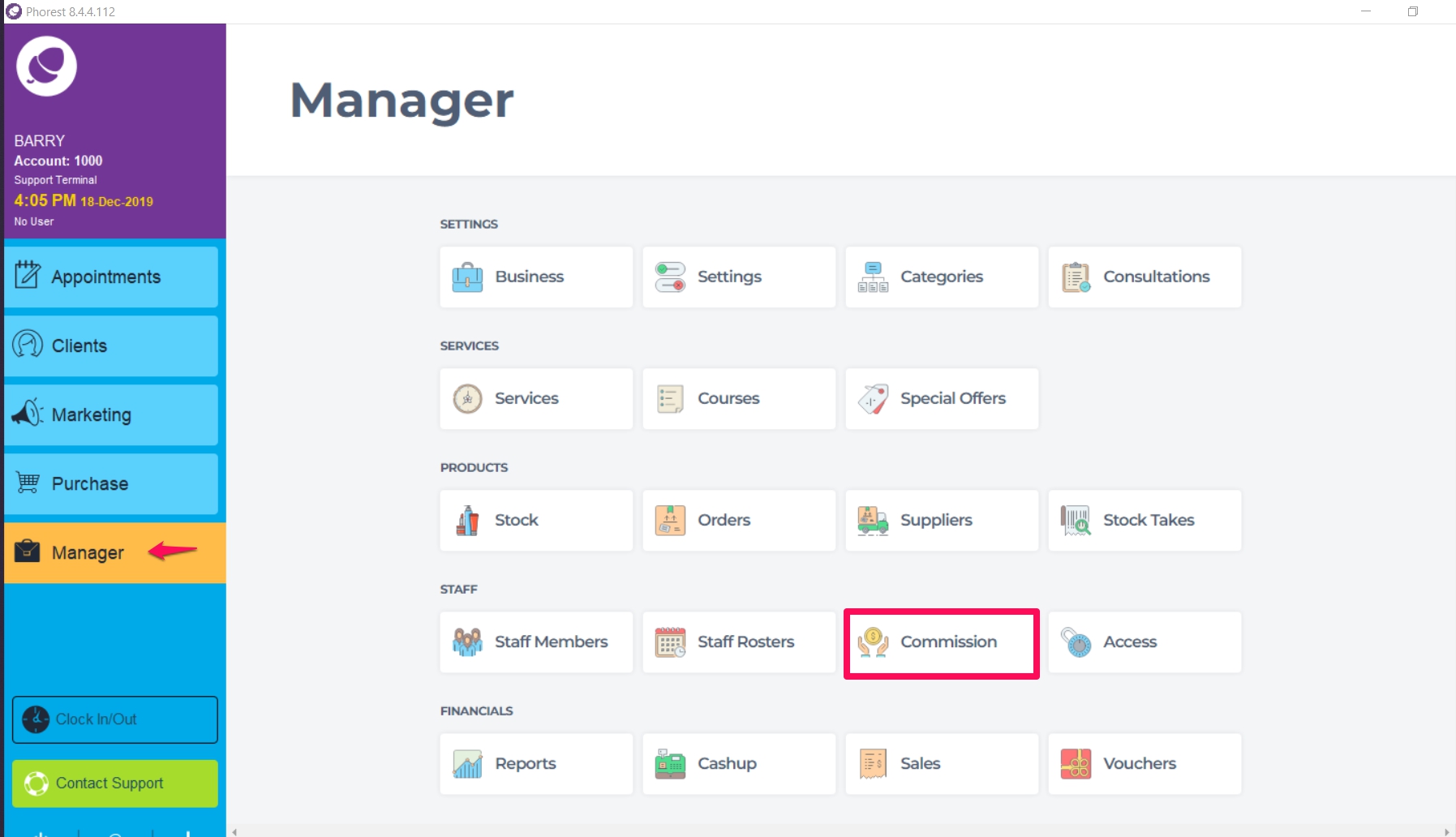

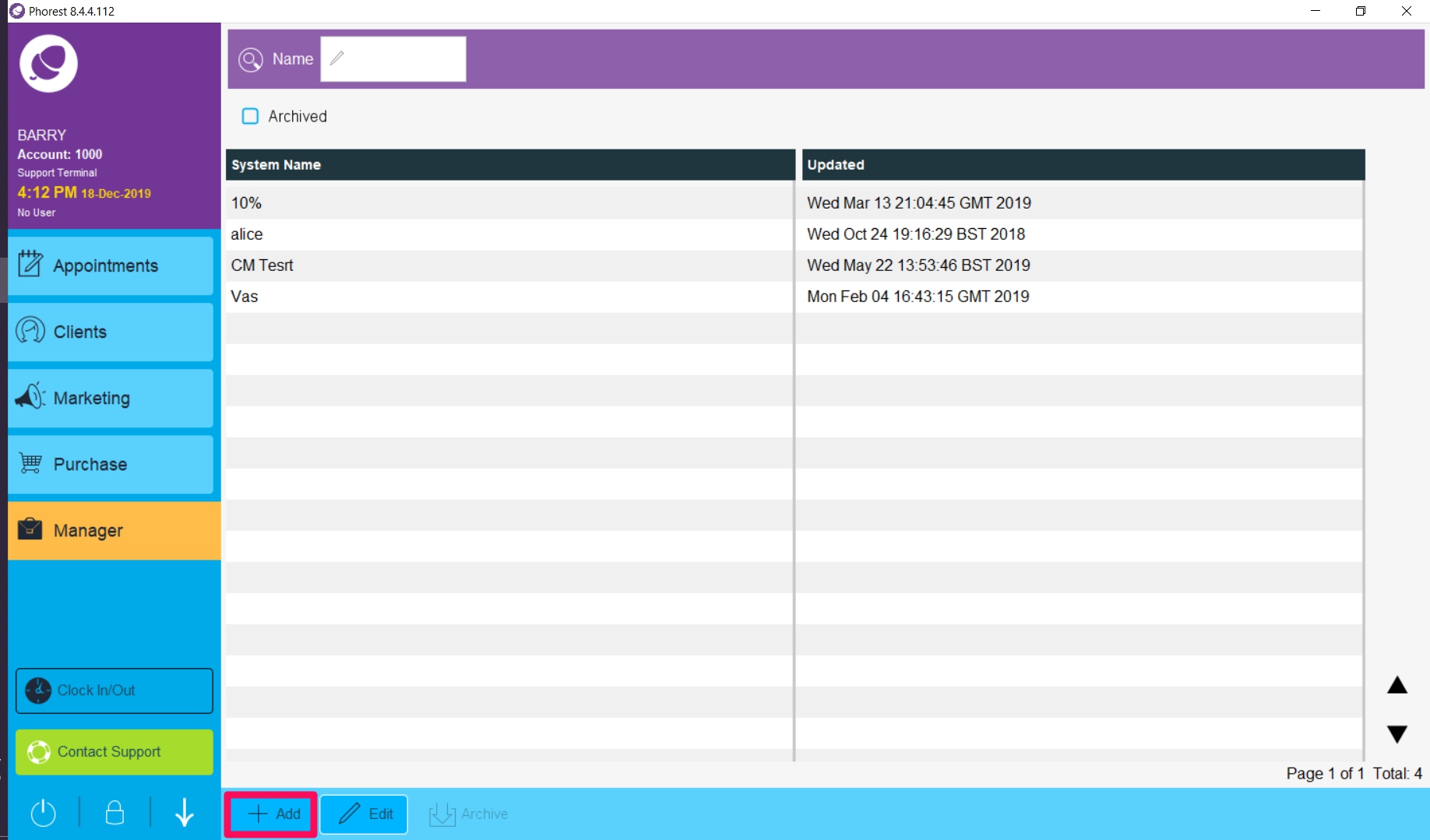

Setup Commission as normal. Go to Manager and Commission.

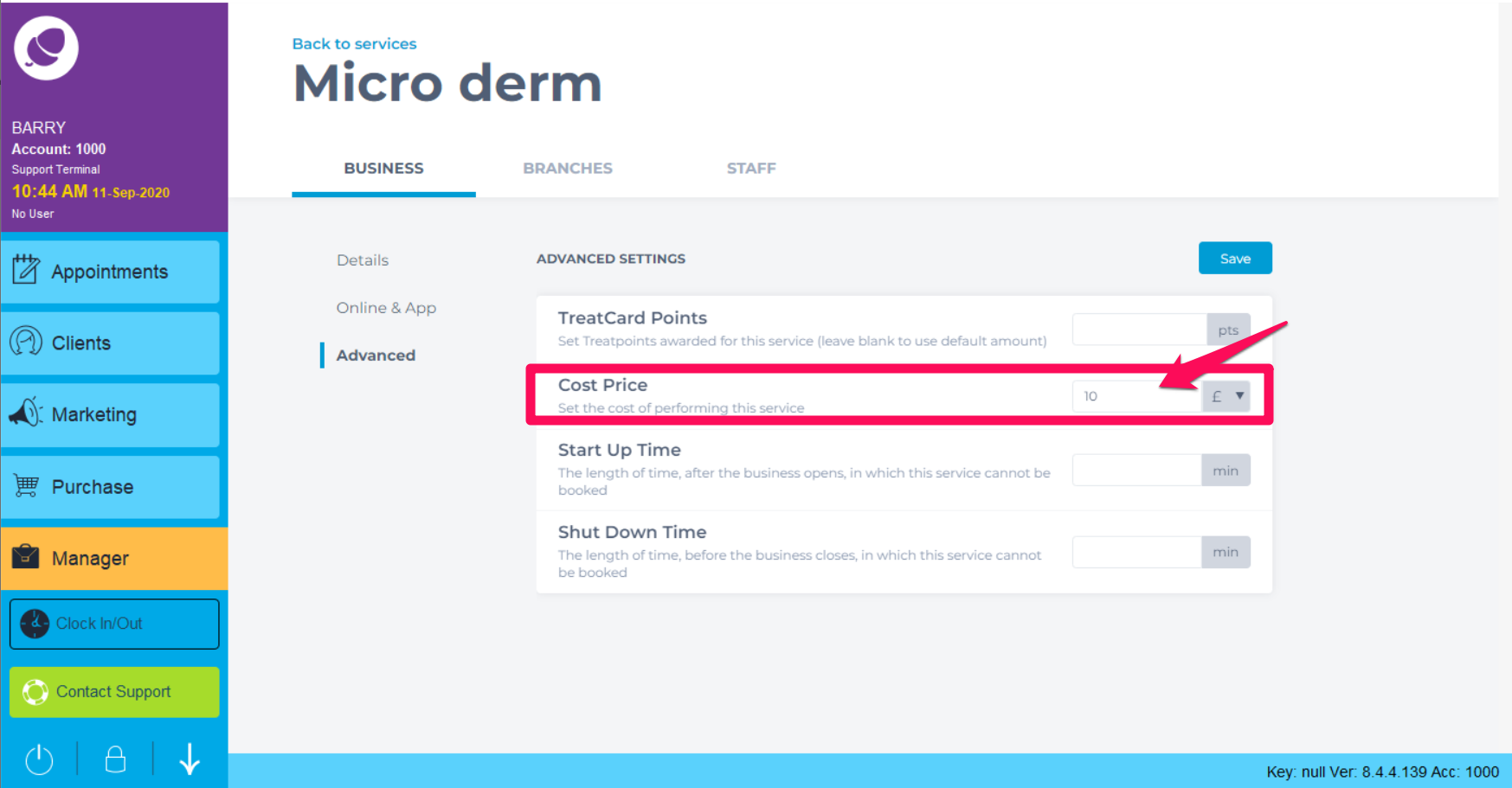

Mary does a service called Microdermabrasion Facial for a client with a price of 70 which has a service cost of 10. (You enter the cost of service in the Services section)

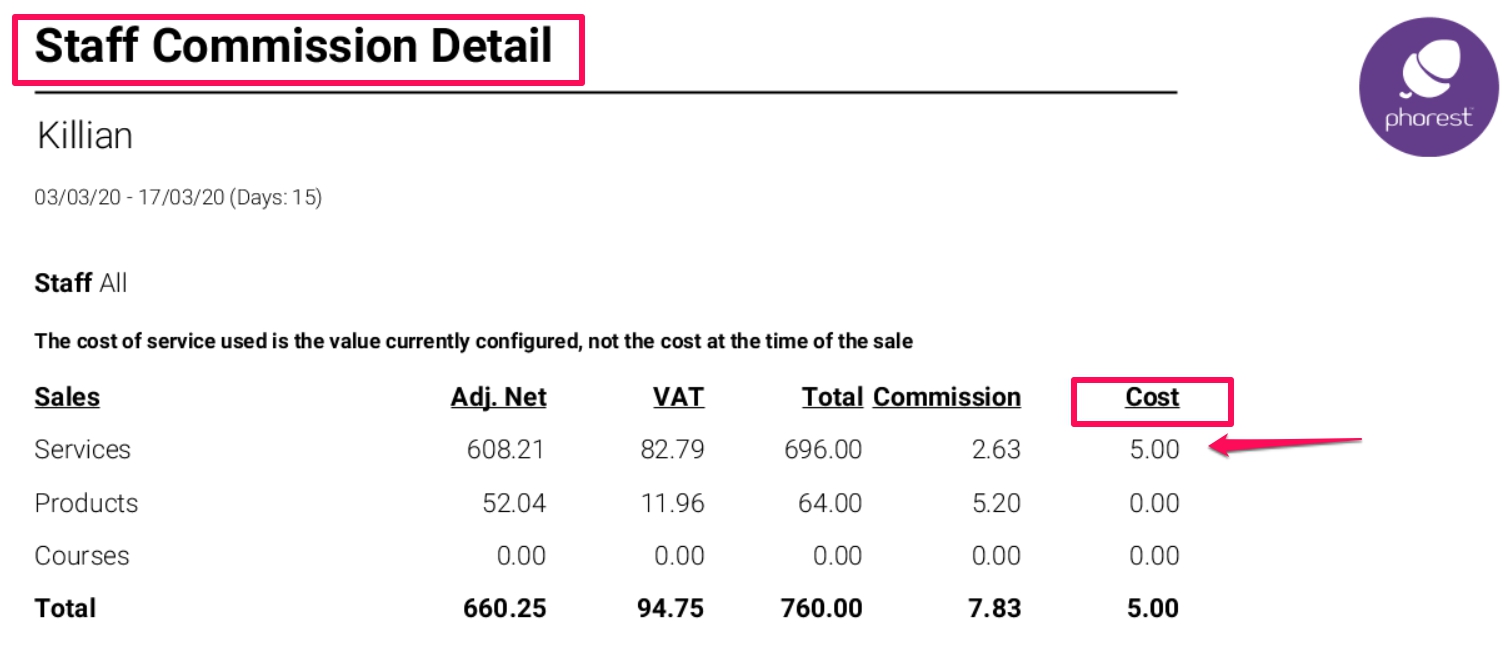

Go to Reports and run the Staff Commission Detail with the option for Deducting Cost of Service ticked. (You can also use this on the Staff Commission Overview)

Things to note when using filter Deduct the cost of service from the commission

- Cost of services will be deducted on all services, courses session, special offers and packages.

- When running reports it takes the current cost value in services.

Please note this only applies to service commission, not retail.

To learn about more areas like this in your Phorest system enrol in our Staff Setup series in Phorest Academy - online, on-demand and on-the-go learning for busy salon professionals.