Salons or Spas that do a lot of Courses - they have the option of only paying VAT based on when a course session is performed rather than when the course is sold. This is good because you collect the money when the course is sold but may only pay the VAT on it over 6 months or more bit by bit as each session is performed. To calculate VAT this way - you don't use the Totals report. Instead you use the Staff Performance Overview.

Step-by-step guide

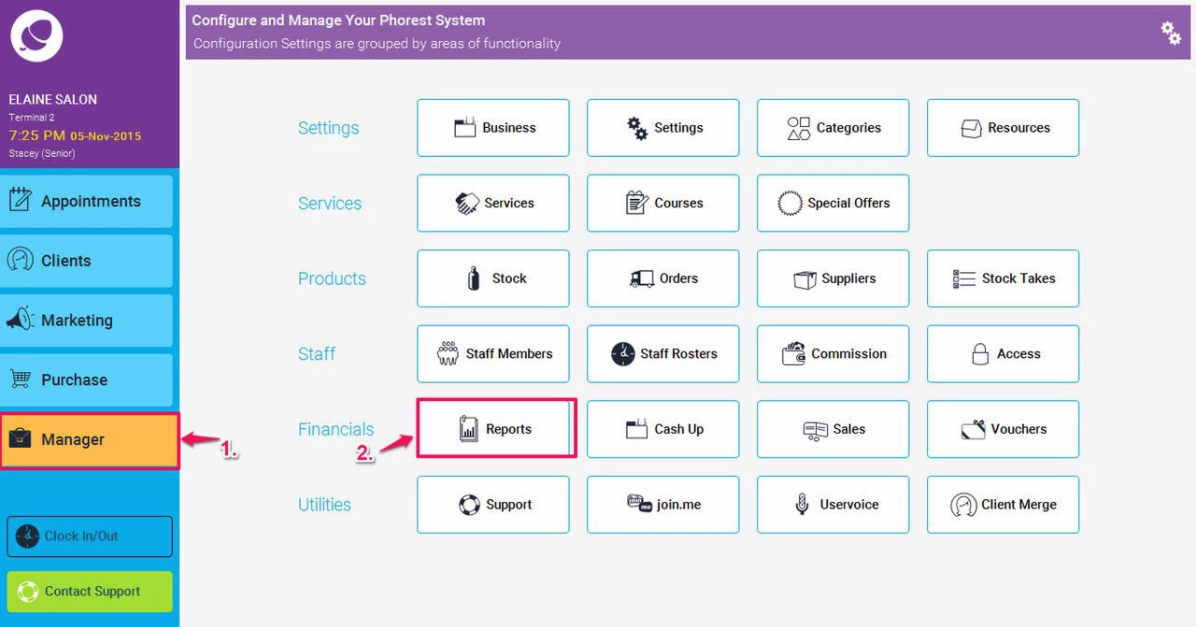

- Go to Reports in the Manager section.

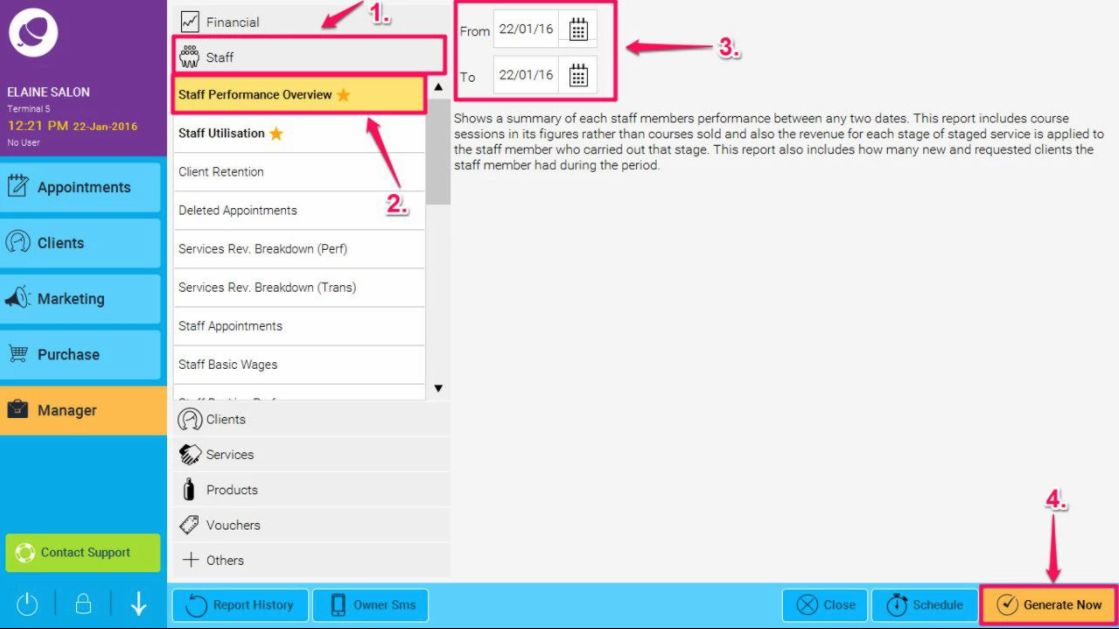

- Select Staff (1.) and highlight the top Report in here called Staff Performance Overview (as illustrated in point 2. below) then choose a suitable start and end date (3.), and finally, click the Generate Now button (4.)

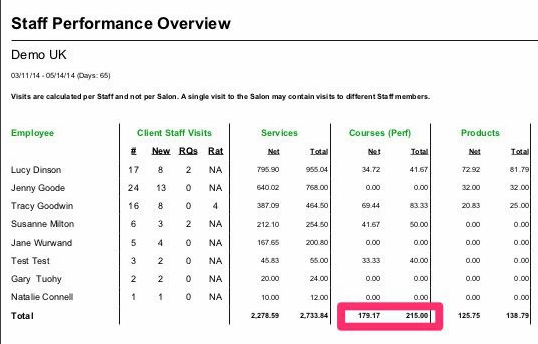

- When you run the report you are looking for the Total at the bottom of the Courses performed section.

The part you are looking for is the courses performed totals underneath the list of what each therapist has performed.

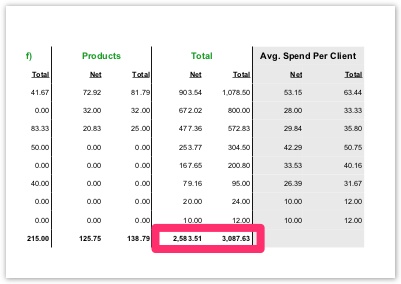

The services and products totals should match what you will find on the Totals report. So you can use the Total column on this report for your total VAT on sales. Just deduct the Net from the Total to get your VAT on sales figure.

You can also choose to pay VAT when vouchers are redeemed rather than when they are sold using the Totals Report.